r&d tax credit calculator 2020

Fifty percent of that average would be 24167. If You Dont Qualify You Dont Pay.

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

See If Youre Eligible To Claim A RD Tax Credit.

. A to Z Constructions average QREs for the past three years would be 48333. If You Dont Qualify You Dont Pay. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

To find out if you are receiving the full benefit of the RD tax credit use our tax credit. The RD tax credit as prescribed in 26 USC. The information is based on the RD tax credit rates as of 1 January 2018.

Our RD tax credit calculator helps you to estimate what RD tax credits could be worth to your business. The results from our RD Tax Credit Calculator are only estimated. Code 41 also known as the Research and Experimentation RE tax credit is a federal benefit that provides companies dollar-for-dollar cash savings for.

It should not be used as a basis for calculations submitted in your tax. The Tax Credit Calculator is indicative only and for information purposes. October 2021 Update IRS Outlines Requirements for Research Credit Refund Claims.

The next step is easy. See If Youre Eligible To Claim A RD Tax Credit. RD tax credits are available to all organizations that engage in certain activities to develop new or improved products processes software techniques formulas or inventions.

With the current year 2021 the average for the previous three-year period 2018-2020 would be 240000380000. An option exists to surrender the loss. As we near the end of a very tumultuous 2020 we wanted to bring you up to date on several current developments that may have an impact on your Research and Development RD Tax.

Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. Any additional amounts of QREs claimed by the taxpayer on its Form 6765 Credit for Increasing Research Activities Form 6765 for the Credit Year that exceeds the Adjusted.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. The current deduction rate is 130. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

What is the RD tax credit worth. Ardy Esmaeili CPA is a Startup Tax Accountant and Tax. You take 50 or half of this.

How to calculate the RD tax credit using the traditional method. 41 may be claimed by taxpaying businesses that develop design or improve products processes formulas or software. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

File the RD tax credit on Form 6765 Credit for Increasing Research Activities which is a part of your 2020 annual corporate form 1120 US Corporation Income Tax Return. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. Federal tax law provides a benefit in the form of a nonrefundable tax credit for companies that engage in qualified research and.

RD Tax Credit Calculator. This credit appears in the Internal Revenue Code section 41 and is. This is a dollar-for-dollar credit against taxes.

An RD Tax credit is available if a trading loss exists after the RD additional deduction. If in 2022 A to Z Construction had. Call us at 208 252-5444.

The RD tax credit regularly provides a wide range of businesses with a source of extra cashup to 10 of annual RD costs for federal purposes and much more when state. Code 41 Credit for increasing research. The RD Tax Credit 26 US.

For most companies the credit is worth 7-10 of qualified research expenses. Use Burklands RD Tax Credit Calculator to see how much your startup would save with the startup RD Credit.

R D Tax Credit Calculation Adp

Charitable Donations Tax Credits Calculator Canadahelps

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Examples Mpa

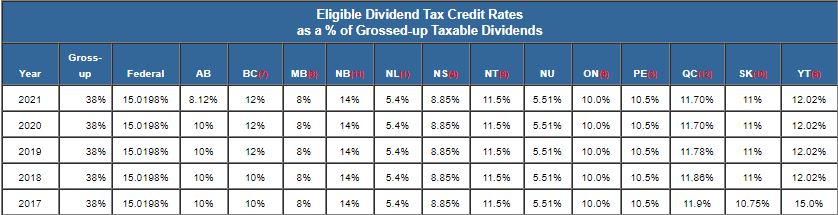

Taxtips Ca Dividend Tax Credit For Eligible Dividends

R D Tax Credit Calculation Examples Mpa

How To Calculate Gross To Net Pay Financial Documents Federal Income Tax Calculator

Banking Finance Thin Icons Creative Market Finance Bank Banking Finance

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Taxtips Ca Ontario Non Refundable Lift Credit

Tax Credit Calculator Sunnybrook Foundation

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

R D Tax Credit Calculation Examples Mpa

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

What Are Marriage Penalties And Bonuses Tax Policy Center

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts